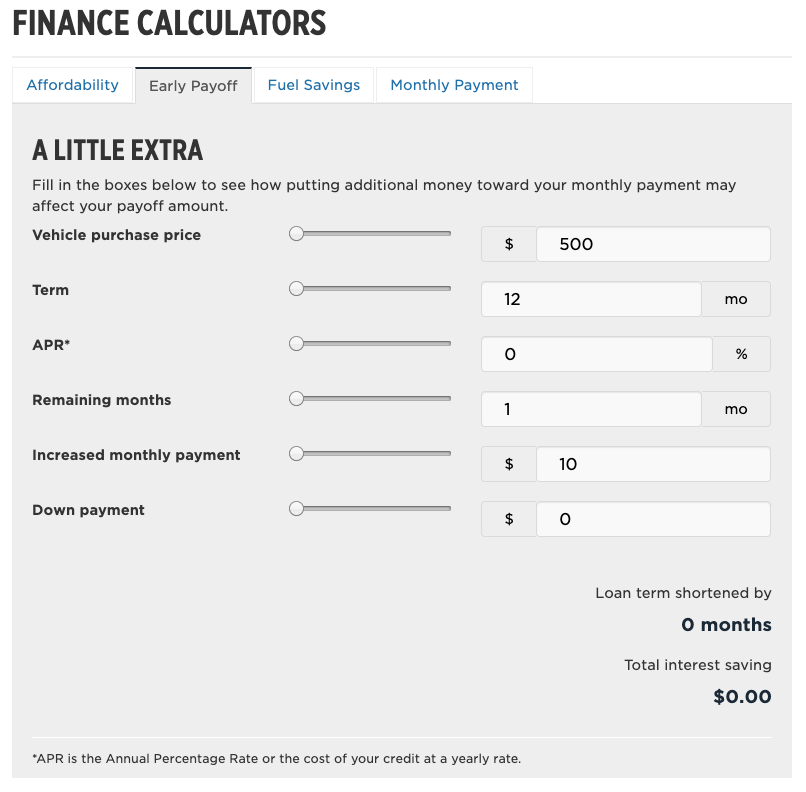

The key to paying off your car loan earlier is always to pay more than the statement balance. Make large additional payments to cut down your car loan balance.Switch to biweekly payments instead of the default monthly payments.Make extra payments toward the principal regularly.Pay every month and never miss a payment.

Your credit score will bounce back when you are responsible for your bills with other accounts.įollow these steps to speed up your payoff process and save money in interest payments.

Remember, the credit score drop is usually only a temporary dip. The drop might be bigger for those who have excellent credit than others who have a low credit score. How much will my credit score drop if I pay off my car loan?Įach person's situation is different and the calculation the credit bureaus use to calculate credit scores is complicated, there is really no way to tell how much your credit score will drop after you pay off your auto loan.įor someone who has no other payment accounts, the drop may be more dramatic than for another who has many accounts. It will happen sooner or later as you will eventually pay off your car loan either today or a few years later when your term is over.Īfter the initial dip, your credit score should rebound quickly if you make payments on time with your other accounts such as credit cards. However, do not let this scare you from paying off your auto loan. Yes, when you pay off your auto loan, your credit score will drop initially because when you pay off your auto loan, the account will be closed and will no longer help you establish a payment history. When you make timely payments to pay off your credit card every month, your credit score will be improved.ĭoes a car loan payoff hurt your credit score? You can build your credit score with other accounts such as credit cards. In most cases, the credit score shouldn't be a deciding factor to decide whether or not to pay off your car loan. Your credit score may dip temporarily but will go back up if you are responsible for your other payments. No, paying off your car loan will not improve your credit score as now you will have one fewer payment account to build your credit score. You should pay off the debt with the highest interest rate before paying off your auto loan.Īnother scenario where you might want to hold off from paying off your auto loan is if you have other investment or business opportunities that have the potential to generate a higher return than the interest costs of your auto loan.ĭoes a car payoff improve your credit score? For example, if you have other debt that has a higher interest rate than your car loan such as credit card debt. In some cases, paying off an auto loan might not be ideal. Therefore, paying off your auto loan is a good idea if you can afford it.

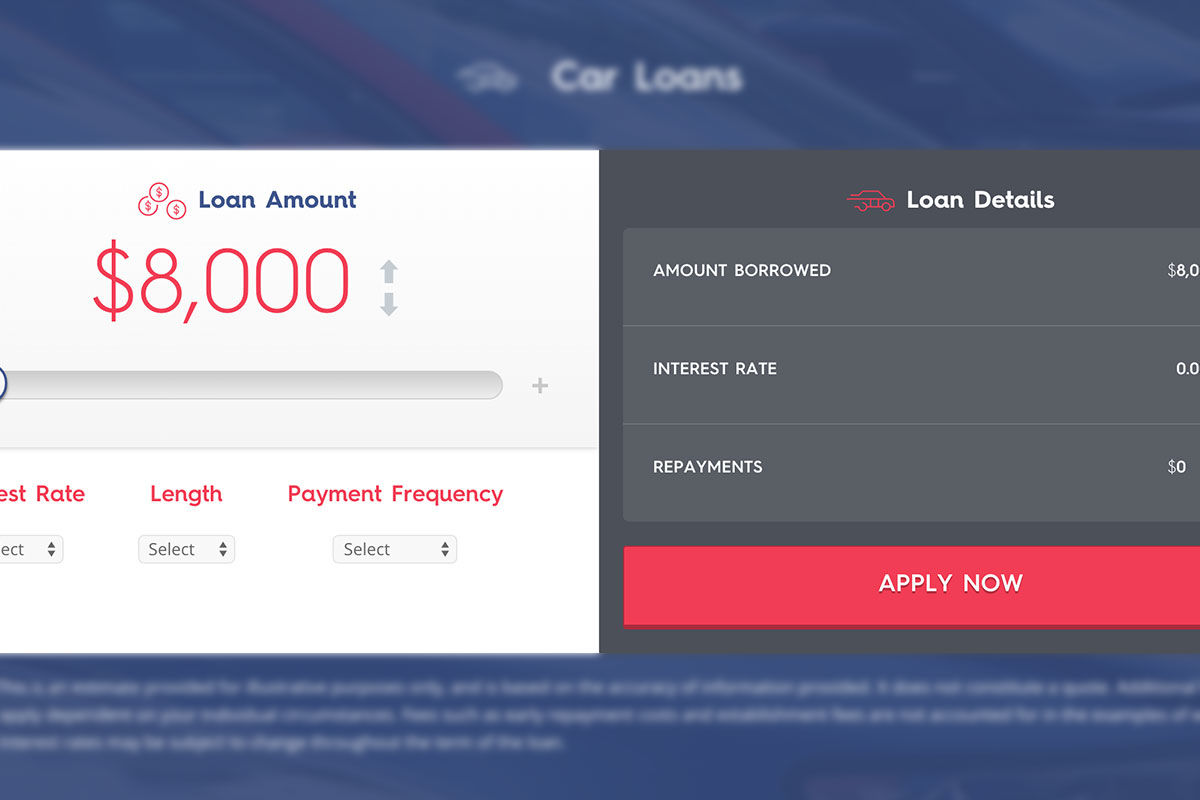

Paying off your auto loan saves you money in interest. Is it a good idea to pay off my auto loan earlier? However, you should first contact your lender to see if there is any prepayment penalty or other restrictions on the auto loan contract. To pay off your auto loan, you can call your lender, visit them in person, or pay them off online if your lender has a platform for you to make payments.

0 kommentar(er)

0 kommentar(er)